All Categories

Featured

Table of Contents

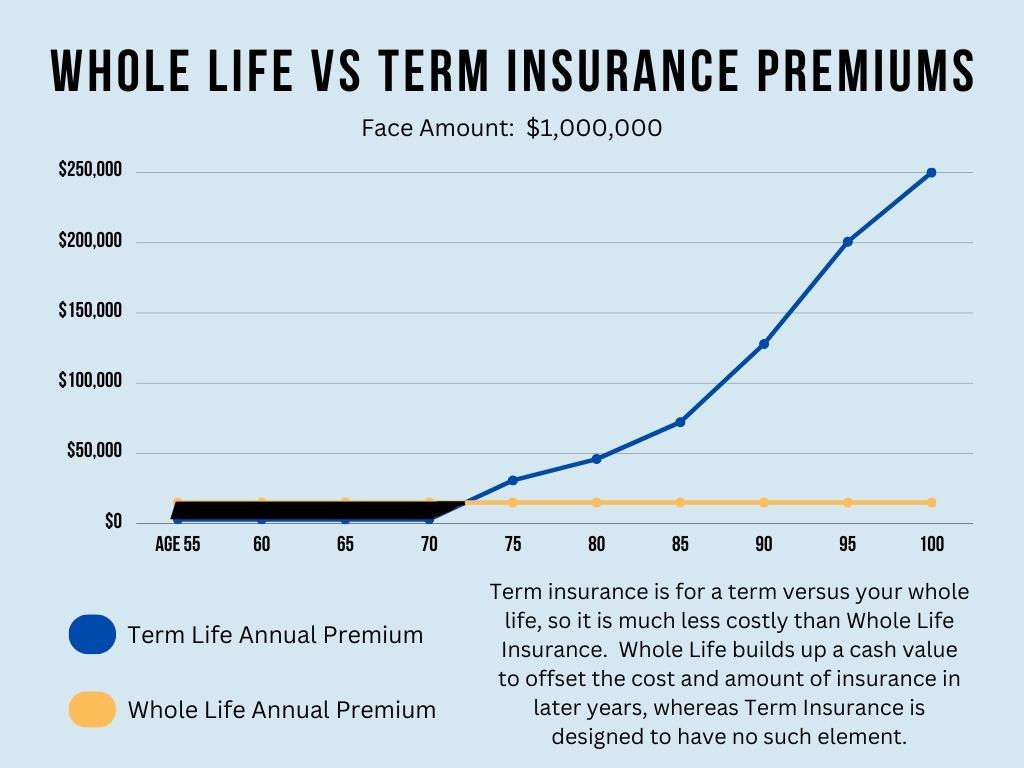

There is no payout if the plan ends prior to your fatality or you live past the plan term. You may have the ability to restore a term policy at expiration, yet the costs will be recalculated based on your age at the time of revival. Term life insurance policy is typically the least costly life insurance policy readily available because it provides a survivor benefit for a restricted time and doesn't have a cash money worth element like long-term insurance policy.

At age 50, the premium would climb to $67 a month. Term Life Insurance policy Rates thirty years old $18 $15 40 years of ages $28 $23 half a century old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in excellent health and wellness. On the other hand, below's a check out prices for a $100,000 whole life plan (which is a kind of irreversible plan, indicating it lasts your life time and includes cash money worth).

Mississippi Term Life Insurance

Passion rates, the financials of the insurance policy business, and state regulations can likewise impact premiums. When you take into consideration the amount of protection you can obtain for your costs dollars, term life insurance policy has a tendency to be the least pricey life insurance coverage.

He gets a 10-year, $500,000 term life insurance coverage plan with a costs of $50 per month. If George passes away within the 10-year term, the plan will pay George's beneficiary $500,000.

If George is diagnosed with a terminal ailment throughout the first policy term, he possibly will not be eligible to restore the plan when it expires. Some policies provide assured re-insurability (without proof of insurability), but such attributes come at a higher expense. There are a number of sorts of term life insurance policy.

Most term life insurance policy has a level costs, and it's the kind we've been referring to in most of this article.

Nevada Term Life Insurance

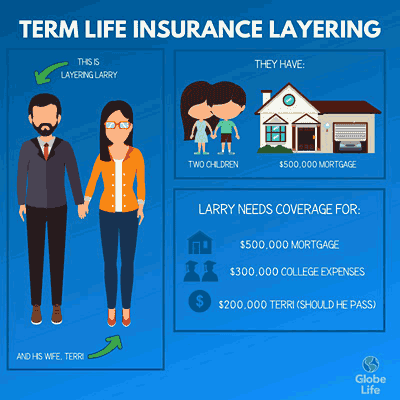

Term life insurance is appealing to young people with youngsters. Moms and dads can obtain significant coverage for a low expense, and if the insured dies while the policy holds, the household can rely upon the fatality benefit to replace lost income. These policies are additionally fit for individuals with expanding families.

The appropriate choice for you will certainly rely on your requirements. Below are some points to take into consideration. Term life plans are suitable for people who want considerable coverage at an inexpensive. Individuals that have whole life insurance policy pay a lot more in costs for less protection yet have the safety of knowing they are protected forever.

The conversion cyclist should enable you to convert to any permanent policy the insurance provider offers without constraints - aaa direct term life insurance reviews. The primary functions of the cyclist are maintaining the original health and wellness score of the term policy upon conversion (also if you later have health and wellness problems or end up being uninsurable) and choosing when and exactly how much of the protection to convert

Of training course, overall premiums will certainly raise considerably since whole life insurance policy is extra expensive than term life insurance policy. Medical conditions that develop during the term life duration can not create premiums to be raised.

Whole life insurance coverage comes with substantially higher monthly costs. It is indicated to provide protection for as long as you live.

No Load Term Life Insurance

Insurance companies set an optimum age restriction for term life insurance coverage policies. The costs additionally rises with age, so an individual aged 60 or 70 will pay substantially more than somebody years more youthful.

Term life is somewhat comparable to cars and truck insurance. It's statistically not likely that you'll require it, and the costs are cash down the tubes if you don't. But if the most awful happens, your family members will obtain the advantages.

This policy design is for the customer who requires life insurance but want to have the capability to pick just how their cash money value is spent. Variable plans are financed by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award information, check out Irreversible life insurance policy develops cash worth that can be borrowed. Policy lendings accumulate passion and unpaid policy fundings and interest will decrease the death advantage and cash money value of the plan. The amount of cash worth available will generally depend on the kind of irreversible policy bought, the quantity of coverage bought, the length of time the policy has actually been in pressure and any superior plan finances.

Renewable Term Life Insurance Advantages And Disadvantages

Disclosures This is a general summary of coverage. A total declaration of coverage is found only in the plan. For even more information on coverage, expenses, limitations, and renewability, or to obtain insurance coverage, contact your local State Farm agent. Insurance coverage and/or connected riders and features might not be offered in all states, and plan terms and problems may vary by state.

The main differences between the different types of term life plans on the marketplace relate to the size of the term and the insurance coverage quantity they offer.Level term life insurance policy features both level costs and a degree survivor benefit, which means they remain the very same throughout the duration of the plan.

, also recognized as a step-by-step term life insurance coverage strategy, is a plan that comes with a fatality advantage that increases over time. Typical life insurance term sizes Term life insurance is affordable.

Although 50 %of non-life insurance policy owners point out cost as a reason they don't have coverage, term life is just one of the cheapest sort of life insurance policy. You can typically obtain the insurance coverage you require at a convenient rate. Term life is simple to take care of and comprehend. It supplies insurance coverage when you most need it. Term life provides financial defense

during the duration of your life when you have major monetary commitments to fulfill, like paying a home loan or funding your kids's education. Term life insurance coverage has an expiration day. At the end of the term, you'll require to get a new policy, renew it at a greater costs, or transform it into long-term life insurance policy if you still desire coverage. Prices might vary by insurance company, term, insurance coverage amount, wellness class, and state. Not all plans are available in all states. Rate image legitimate since 10/01/2024. What aspects impact the expense of term life insurance? Your rates are determined by your age, gender, and health and wellness, along with the insurance coverage quantity and term length you choose. Term life is a good fit if you're searching for a budget friendly life insurance policy plan that only lasts for a set amount of time. If you need permanent insurance coverage or are taking into consideration life insurance policy as a financial investment choice, entire life could be a far better choice for you. The primary distinctions in between term life and entire life are: The size of your protection: Term life lasts for a set duration of time and after that expires. Average regular monthly entire life insurance policy rate is calculated for non-smokers in a Preferred wellness classification, acquiring an entire life insurance plan compensated at age 100 offered by Policygenius from MassMutual. Rates might vary by insurance firm, term, protection amount, health course, and state. Not all policies are readily available in all states. Temporary life insurance coverage's temporary policy term can be a great option for a few circumstances: You're awaiting approval on a lasting policy. Your policy has a waitingperiod. You remain in between work. You wish to cover short-term commitments, such as a finance. You're enhancing your wellness or lifestyle(such as quitting smoking)prior to obtaining a traditional life insurance policy plan. Aflac offers many lasting life insurance policy plans, consisting of entire life insurance policy, last expense insurance policy, and term life insurance policy. Start chatting with a representative today to find out more concerning Aflac's life insurance policy items and locate the right option for you. The most popular kind is now 20-year term. The majority of business will certainly not market term insurance coverage to an applicant for a term that ends past his/her 80th birthday . If a plan is"sustainable," that indicates it proceeds effective for an extra term or terms, as much as a defined age, even if the health and wellness of the guaranteed (or other variables )would trigger him or her to be rejected if she or he made an application for a new life insurance policy plan. Premiums for 5-year eco-friendly term can be degree for 5 years, then to a brand-new rate mirroring the new age of the insured, and so on every 5 years. Some longer term plans will certainly guarantee that the costs will certainly notincrease during the term; others do not make that assurance, allowing the insurance coverage firm to elevate the rate during the plan's term. This suggests that the policy's proprietor can change it into a long-term kind of life insurance policy without additional proof of insurability. In a lot of sorts of term insurance, consisting of property owners and vehicle insurance, if you have not had a case under the policy by the time it expires, you get no reimbursement of the premium. Some term life insurance consumers have been miserable at this end result, so some insurers have actually produced term life with a"return of premium" function. The costs for the insurance with this function are typically considerably greater than for policies without it, and they generally require that you maintain the policy in force to its term or else you forfeit the return of premium advantage. Married with kids-Life insurance can aid your spouse keep your home, current lifestyle and offer your children's assistance. Solitary moms and dad and sole breadwinner- Life insurance policy can aid a caregiver cover child care costs and various other living expenses and satisfy plans for your child's future education. Married without children- Life insurance policy can provide the cash to meet economic obligations and assist your spouse hold onto the possessions and lifestyle you've both strove to accomplish. You might have the alternative to transform your term plan to permanent life insurance policy. Coverage that shields someone for a defined period and pays a survivor benefit if the covered person passes away during that time. Like all life insurance policy policies, term coverage assists maintain a household's financial well-being in instance a loved one passes away. What makes term insurance coverage various, is that the guaranteed person is covered for a detailsamount of time. Considering that these policies do not give long-lasting insurance coverage, they can be relatively budget friendly when compared to a long-term life insurance plan with the very same quantity of insurance coverage. While a lot of term policies provide dependable, short-term security, some are extra versatile than others. At New York Life, our term policies use a distinct combination of functions that can help if you come to be disabled,2 come to be terminally ill,3 or just desire to transform to a long-term life plan.4 Considering that term life insurance offers short-term defense, several individuals like to match the size of their policy with a crucial landmark, such as settling a home loan or seeing youngsters via college. Level costs term might be much more efficient if you want the premiums you pay to stay the same for 10, 15, or 20 years. As soon as that period ends, the quantity you spend for coverage will certainly enhance annually. While both types of coverage can be efficient, the choice to choose one over the various other comes down to your specific demands. Since no one recognizes what the future has in shop, it is essential to ensure your protection is reliable sufficient to fulfill today's needsand adaptableadequate to assist you prepare for tomorrow's. Below are some key elements to bear in mind: When it involves something this important, you'll want to make certain the business you utilize is economically sound and has a tested background of keeping its guarantees. Ask if there are attributes and advantages you can use in instance your requirements transform later.

Latest Posts

In A Renewable Term Life Insurance Policy The Contract Will Usually

Is Voluntary Life Insurance Whole Or Term

Which Of The Following Is Not A Characteristic Of Term Life Insurance